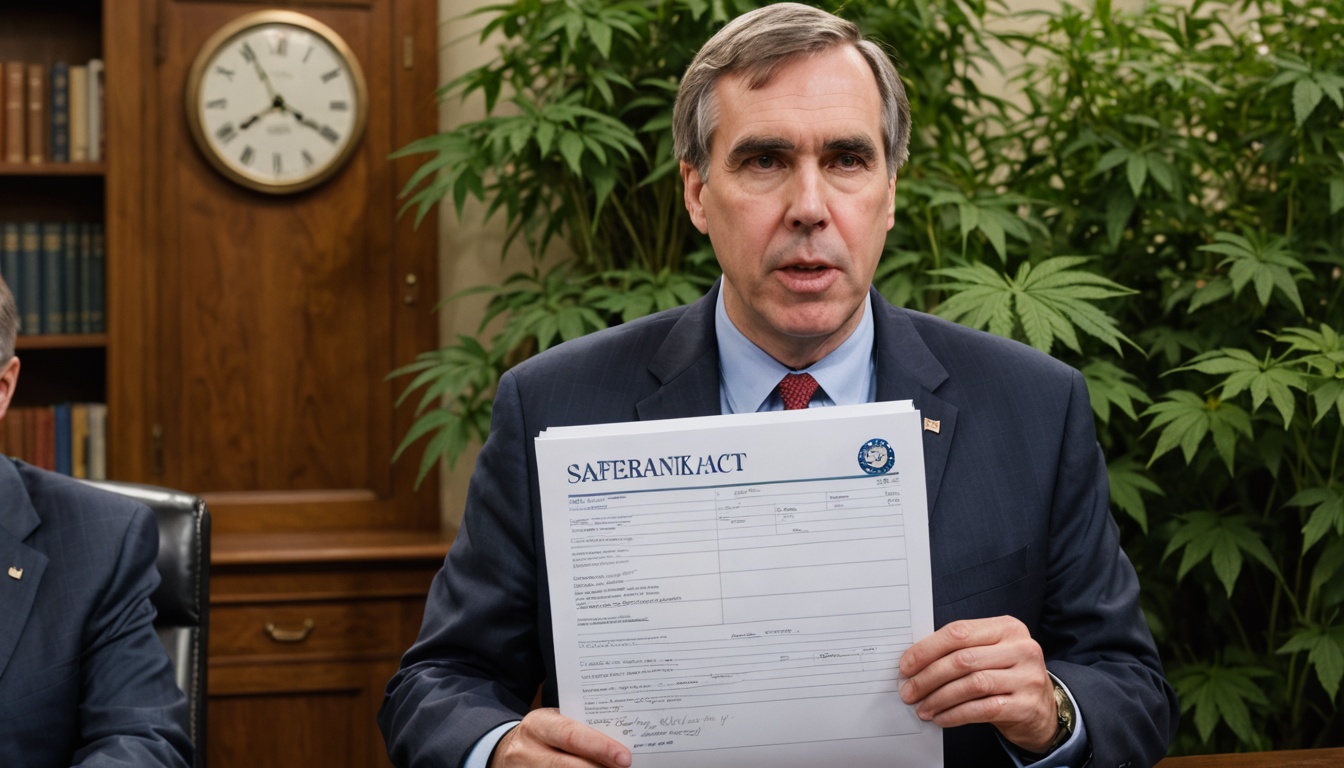

Democratic Senator Jeff Merkley, sponsor of the Secure and Fair Enforcement Regulation (SAFER) Banking Act, expressed optimism that the bill will be taken up in the near future, despite ongoing delays. The legislation aims to prevent federal regulators from penalizing banks for working with state-legal cannabis businesses.

Merkley attributed the delays to other priorities taking precedence, including budget issues and the ongoing war. He noted that efforts to schedule meetings to discuss the bill have been ongoing, but have been unsuccessful due to the competing demands on lawmakers’ time.

The SAFER Banking Act has been a long-standing issue for advocates and industry stakeholders, who see it as a crucial step towards normalizing the cannabis industry. The bill has cleared a Senate committee but has yet to be introduced in the current Congress.

Meanwhile, Republican Senator Bernie Moreno, the lead GOP sponsor of the bill, has expressed skepticism that it will be taken up until the fall. The bill’s introduction has been delayed several times, with some reports suggesting that it may be included in a cryptocurrency bill.

The lack of progress on the cannabis banking issue has been a source of frustration for the industry, which has been plagued by limited access to financial services. Despite President Donald Trump’s endorsement of marijuana industry banking access during his campaign, the issue has yet to be addressed.

In recent months, congressional researchers have released a report detailing the challenges faced by the cannabis industry in accessing banking services, and the Government Accountability Office has announced plans to convene focus groups to better understand the issue. However, the lack of progress on the issue has been attributed to a lack of sufficient Republican support in the Senate.

Despite the challenges, some lawmakers remain hopeful that the issue can be addressed. In March, a Republican lawmaker expressed optimism that Congress will be able to pass a marijuana banking bill this session, arguing that the current barriers to financial services for the industry represent a “second tier” of prohibition.